How To Give Employees W2

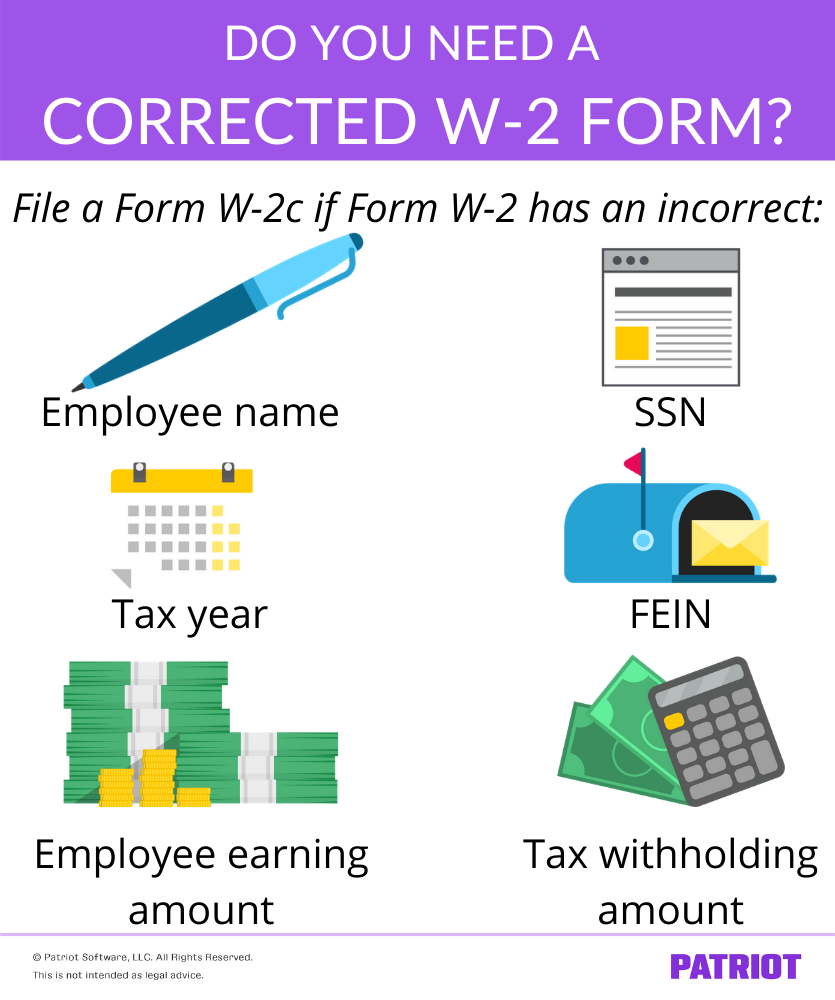

If you want your new employee to add their personal info select the Ask this employee to enter their personal tax and banking info with QuickBooks Workforce checkbox. To correct a Form W-2 you have already submitted file a Form W-2c with a separate Form W-3c for each year needing correction.

How To Get Your W2 Form Online For Free 2020 2021

How To Get Your W2 Form Online For Free 2020 2021

Be sure the Forms W-2 you provide to.

How to give employees w2. If January 31st falls on a Saturday Sunday or legal holiday the deadline will be the next business day. The W-2 form is available on the IRS website. This will automatically invite your employee to see their pay stubs and W-2s.

Follow the instructions provided by the IRS for filling out each W-2 form. Small Business Administration estimates that 35 of small-business owners offer some type of end-of-year bonus but there is a wide spectrum of methods amounts and types of employee. You may furnish Forms W-2 to employees on IRS official forms or on acceptable substitute forms.

Your employer is required to provide you with Form W-2 Wage and Tax Statement. You have 16425 minutes to spend as much of the money as possible and you must spend the money on yourself not kids not a spouse nobody but yourself. Create a Microsoft 365 account for the employee.

The deadline is the same for giving the W-2 to employees and filing it with the SSA. You may find that appointing a person to oversee benefits can help streamline workflow and give employees a point person to whom they can go with questions. Box D contains the W-2 control number.

Have them meet you in the middle of the mall when time is up for a show-and-tell about what they bought. Box A is for the employees SSN while Box B is for the employer identification number. Explain where to sign in.

But again there is a cost associated with either hiring a new employee to do this or making it part of a current employees duties. Employers must mail W-2 forms to their employees by January 31 of the following calendar year. You will enter the following information.

When filing a Form W-2 you need to make sure that each box on the form contains the correct information. Employers must furnish these copies of Form W-2 to employees from whom. Send W-2 forms for all employees to the Social Security Administration SSA by the same date January 31 of the year after the tax year.

However if you terminate your business see Terminating a business. If you never received a W-2 when you were supposed to your employer should still have a copy of your W-2 for the year in question up to six years prior. If an employee loses a Form W-2 write REISSUED STATEMENT on the new copy and give it to the employee.

If you have printed out the forms internally you can simply reprint the W-2 form and give it or mail it to the employee. You dont need to add REISSUED STATEMENT to the copy you send to the SSA. Help your employee get started.

Add your employees info including their email address. Name address and Social Security number for each employee. Also provide a Form W-2c to the employee as soon as possible.

Employees who receive a W-2 are paid through their employers payroll and have their payroll taxes withheld throughout the year. Employers must furnish Copies B C and 2 of Form W-2 to employees by January 31. Employers must file Copy A of Form s W-2 to the Social Security Administration by January 31st.

Every employer engaged in a trade or business who pays remuneration including noncash payments of 600 or more for the year all amounts if any income social security or Medicare tax was withheld for services performed by an employee must file a Form W-2 for each employee even if the employee is related to the employer from whom. The control number is a unique code that identifies the form for your records. If your employer does not provide online access to your W-2 they must mail or hand-deliver your W-2 to you no later than January 31st.

Employee bonuses might seem like a fun perk to you but to your employees it could mean so much more. You must register to use Business Services Online Social Securitys suite of services that allows you to file W-2W-2Cs online and verify your employees names and Social Security numbers against our records. File Forms W-2c Corrected Wage and Tax Statement and W-3c Transmittal of Corrected Wage and Tax Statement as soon as possible after you discover an error.

If you are not sure if you have online access please check with your company HR or Payroll department. Select Add an employee. Afterwards go to dinner together.

If an employee asks for Form W-2 give him or her the completed copies within 30 days of the request or within 30 days of the final wage payment whichever is later. Income Social Security or Medicare tax was withheld. Give each employee 16425 with these rules.

This article helps you onboard a new employee to Microsoft 365 for business. The six years should start after the initial delivery date. Some W-2s end up coming back as undeliverable and the IRS requires these W-2s to be kept for a six-year minimum.

Business owners can also generate and file W-2s through Square Payroll. Give the employee their user ID and password.

Instant W2 Form Generator Create W2 Easily Form Pros

Instant W2 Form Generator Create W2 Easily Form Pros

Irs Releases Instructions For Forms W 2 And W 2c Reporting Of Employee Deferral And Repayment Of Social Security Taxes Under Irs Notice 2020 65

Pin By Bianca Kim On Quick Saves In 2021 Internal Revenue Service Tax Forms Fillable Forms

Pin By Bianca Kim On Quick Saves In 2021 Internal Revenue Service Tax Forms Fillable Forms

Editable W2 Form 2015 Printable W2 Form For Employees 2015 Employee Tax Forms Tax Forms Statement Template

Editable W2 Form 2015 Printable W2 Form For Employees 2015 Employee Tax Forms Tax Forms Statement Template

So You Have Stock Compensation And Your Form W 2 Just Arrived Now What The Mystockoptions Blog

So You Have Stock Compensation And Your Form W 2 Just Arrived Now What The Mystockoptions Blog

Beauty Store Business How To Classify Employees 1099 Or W2 Billionaire Lifestyle Luxury Private Jets Business Inspiration

Beauty Store Business How To Classify Employees 1099 Or W2 Billionaire Lifestyle Luxury Private Jets Business Inspiration

Invite Your Employees To Quickbooks Workforce To See Pay Stubs W 2s And More Quickbooks Quickbooks Online Financial Advice

Invite Your Employees To Quickbooks Workforce To See Pay Stubs W 2s And More Quickbooks Quickbooks Online Financial Advice

Form W2 Everything You Ever Wanted To Know

Form W2 Everything You Ever Wanted To Know

How To Correct A W 2 Form Irs Form W 2c Instructions

How To Correct A W 2 Form Irs Form W 2c Instructions

![]() Looking To Hire W2 Vs 1099 Which Is Best For Your Business

Looking To Hire W2 Vs 1099 Which Is Best For Your Business

Download W 2 Form W 2 Employer Federal Copy A Printable Job Applications W2 Forms Employment Application

Download W 2 Form W 2 Employer Federal Copy A Printable Job Applications W2 Forms Employment Application

So You Have Stock Compensation And Your Form W 2 Just Arrived Now What The Mystockoptions Blog

W 2 Vs W 4 What S The Difference Seek Business Capital

W 2 Vs W 4 What S The Difference Seek Business Capital

Download W2 Form 2016 Fillable Form W 4 Employee S Withholding Allowance Tax Forms Income Tax Form

Download W2 Form 2016 Fillable Form W 4 Employee S Withholding Allowance Tax Forms Income Tax Form

W 2 Vs W 4 What S The Difference Seek Business Capital

W 2 Vs W 4 What S The Difference Seek Business Capital

20 Work From Home Jobs That Offer W2 Employment Remote Jobs Work From Home Jobs Work From Home Business

20 Work From Home Jobs That Offer W2 Employment Remote Jobs Work From Home Jobs Work From Home Business

How To Find Your W2 Form Online Finding Yourself W2 Forms Online

How To Find Your W2 Form Online Finding Yourself W2 Forms Online

W2 Forms Copy B Employee Federal Discount Tax Forms

W2 Forms Copy B Employee Federal Discount Tax Forms

W4 Form Explained 4 Important Life Lessons W4 Form Explained Taught Us Tax Forms Income Tax W2 Forms

W4 Form Explained 4 Important Life Lessons W4 Form Explained Taught Us Tax Forms Income Tax W2 Forms

Tidak ada komentar untuk "How To Give Employees W2"

Posting Komentar